All Categories

Featured

Table of Contents

Which one you choose depends on your needs and whether the insurance provider will accept it. Policies can likewise last until specified ages, which for the most part are 65. Since of the countless terms it supplies, level life insurance coverage offers prospective insurance holders with adaptable choices. Yet yet surface-level details, having a better understanding of what these strategies involve will assist guarantee you purchase a plan that satisfies your requirements.

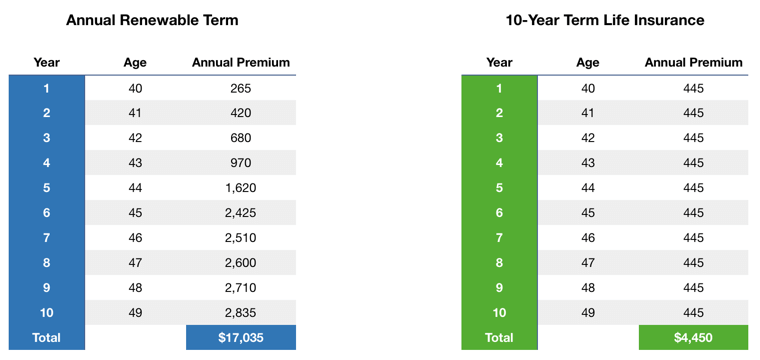

Be mindful that the term you pick will certainly influence the costs you pay for the plan. A 10-year level term life insurance policy policy will set you back less than a 30-year plan due to the fact that there's less opportunity of a case while the strategy is active. Lower threat for the insurance firm relates to decrease costs for the insurance policy holder.

Your family's age ought to also influence your plan term option. If you have children, a longer term makes good sense due to the fact that it secures them for a longer time. If your kids are near adulthood and will certainly be monetarily independent in the near future, a much shorter term may be a better fit for you than a prolonged one.

Nonetheless, when comparing whole life insurance policy vs. term life insurance policy, it deserves keeping in mind that the last generally sets you back less than the former. The result is extra coverage with reduced costs, giving the most effective of both globes if you need a considerable amount of protection yet can't afford an extra costly plan.

What is Annual Renewable Term Life Insurance? A Simple Explanation?

A level death benefit for a term policy typically pays out as a swelling sum. Some degree term life insurance policy firms enable fixed-period settlements.

Passion repayments got from life insurance policy plans are considered revenue and go through taxes. When your level term life plan ends, a few different points can occur. Some insurance coverage ends instantly with no alternative for revival. In various other circumstances, you can pay to extend the plan beyond its initial day or convert it into a long-term policy.

The downside is that your sustainable level term life insurance policy will certainly come with higher costs after its preliminary expiry. Advertisements by Cash. We might be made up if you click this advertisement. Ad For newbies, life insurance coverage can be made complex and you'll have concerns you want answered prior to dedicating to any kind of plan.

Life insurance companies have a formula for computing danger utilizing mortality and passion (30-year level term life insurance). Insurance firms have countless clients securing term life policies at when and use the premiums from its active plans to pay making it through beneficiaries of various other policies. These business make use of mortality to estimate just how numerous individuals within a certain group will file death claims per year, and that details is utilized to figure out average life spans for prospective insurance policy holders

In addition, insurance business can spend the cash they get from premiums and enhance their revenue. The insurance policy business can invest the money and earn returns.

The following section information the pros and disadvantages of degree term life insurance policy. Predictable premiums and life insurance policy coverage Streamlined plan structure Possible for conversion to permanent life insurance coverage Minimal coverage duration No money value accumulation Life insurance costs can boost after the term You'll discover clear advantages when contrasting level term life insurance coverage to various other insurance coverage kinds.

How Does What Is A Level Term Life Insurance Policy Help You?

From the minute you take out a plan, your costs will never ever transform, helping you prepare financially. Your coverage will not vary either, making these plans effective for estate preparation.

If you go this course, your premiums will certainly enhance but it's constantly excellent to have some adaptability if you want to maintain an energetic life insurance policy policy. Sustainable level term life insurance policy is one more choice worth taking into consideration. These policies allow you to maintain your present strategy after expiry, supplying versatility in the future.

Why You Need to Understand Life Insurance Level Term

You'll choose an insurance coverage term with the finest level term life insurance policy rates, but you'll no longer have insurance coverage once the strategy expires. This disadvantage can leave you scrambling to locate a brand-new life insurance coverage plan in your later years, or paying a premium to prolong your current one.

Several entire, global and variable life insurance policy policies have a money value part. With one of those plans, the insurer deposits a section of your regular monthly premium payments right into a cash value account. This account makes interest or is invested, assisting it expand and supply a much more significant payment for your beneficiaries.

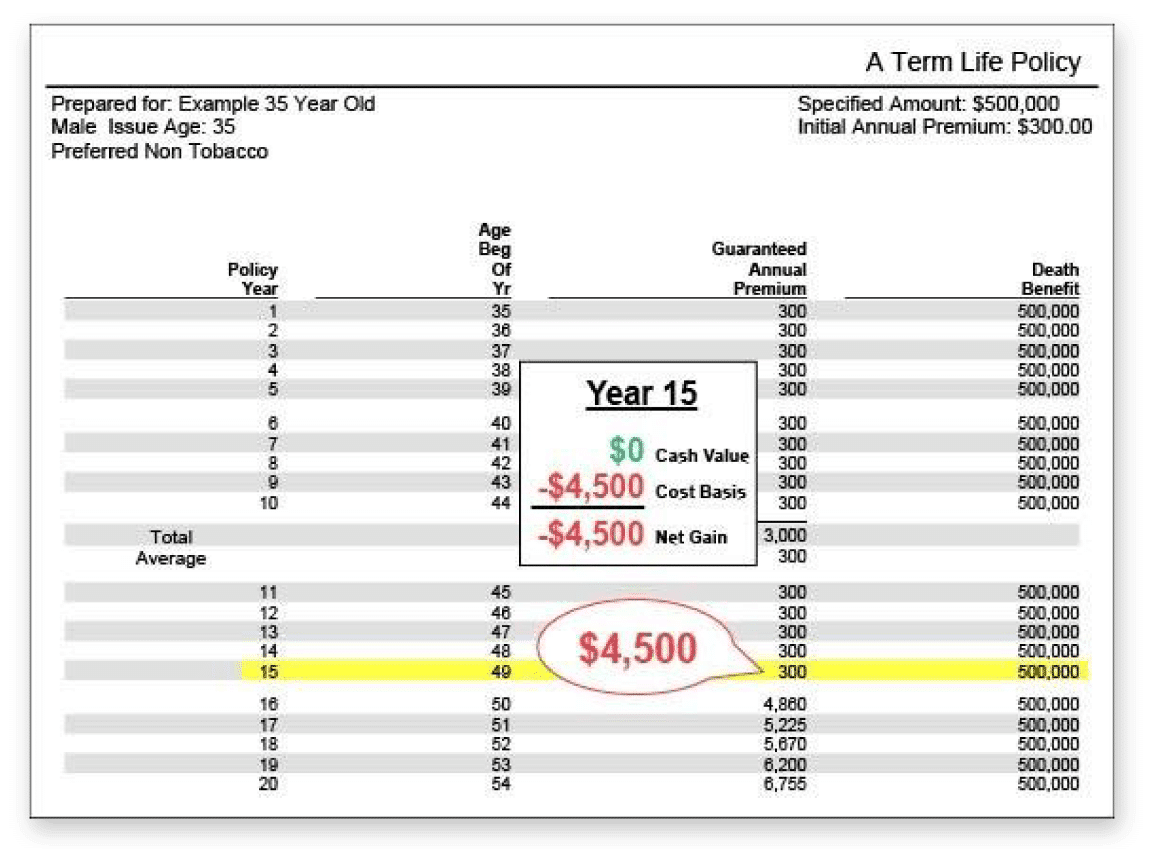

With a degree term life insurance policy policy, this is not the case as there is no money value element. As a result, your plan will not grow, and your death advantage will certainly never ever increase, thereby limiting the payment your beneficiaries will obtain. If you desire a plan that offers a fatality benefit and develops cash money value, check into entire, universal or variable plans.

The 2nd your policy runs out, you'll no more live insurance policy coverage. It's usually feasible to renew your plan, however you'll likely see your premiums boost substantially. This can present issues for retired people on a fixed revenue due to the fact that it's an extra expense they might not be able to manage. Degree term and decreasing life insurance policy deal comparable policies, with the major distinction being the survivor benefit.

It's a kind of cover you have for a particular amount of time, called term life insurance policy. If you were to pass away throughout the time you're covered for (the term), your loved ones receive a set payment concurred when you obtain the plan. You just choose the term and the cover quantity which you might base, for example, on the cost of elevating youngsters until they leave home and you might use the repayment in the direction of: Aiding to pay off your home loan, financial debts, credit report cards or lendings Aiding to pay for your funeral prices Assisting to pay university charges or wedding celebration expenses for your youngsters Helping to pay living costs, changing your earnings.

What is Term Life Insurance For Seniors? Pros, Cons, and Considerations?

The plan has no cash money value so if your payments quit, so does your cover. If you take out a degree term life insurance coverage plan you can: Choose a taken care of quantity of 250,000 over a 25-year term.

Table of Contents

Latest Posts

20-year Level Term Life Insurance

What is Term Life Insurance With Accelerated Death Benefit? How It Works and Why It Matters?

How long does Flexible Premiums coverage last?

More

Latest Posts

20-year Level Term Life Insurance

What is Term Life Insurance With Accelerated Death Benefit? How It Works and Why It Matters?

How long does Flexible Premiums coverage last?