All Categories

Featured

Table of Contents

Costs are normally reduced than whole life plans. With a degree term policy, you can choose your protection amount and the plan size. You're not secured right into a contract for the remainder of your life. Throughout your plan, you never ever need to fret about the costs or survivor benefit quantities altering.

And you can't squander your plan during its term, so you won't get any type of economic take advantage of your past protection. Similar to various other types of life insurance policy, the price of a level term policy depends upon your age, insurance coverage needs, employment, way of living and wellness. Typically, you'll locate extra cost effective insurance coverage if you're younger, healthier and less risky to guarantee.

Given that level term premiums remain the very same for the duration of insurance coverage, you'll understand exactly how much you'll pay each time. Level term protection additionally has some versatility, permitting you to tailor your policy with added functions.

You may have to meet details problems and certifications for your insurance company to establish this motorcyclist. There additionally can be an age or time limitation on the coverage.

Who provides the best Fixed Rate Term Life Insurance?

The survivor benefit is typically smaller sized, and insurance coverage generally lasts up until your youngster turns 18 or 25. This biker may be a more economical method to help guarantee your children are covered as bikers can often cover numerous dependents at the same time. As soon as your youngster ages out of this coverage, it might be possible to transform the motorcyclist right into a new plan.

The most common kind of irreversible life insurance is entire life insurance policy, however it has some key distinctions contrasted to degree term coverage. Below's a basic review of what to consider when comparing term vs.

Whole life insurance lasts insurance coverage life, while term coverage lasts for a specific periodDetails The costs for term life insurance coverage are usually reduced than whole life insurance coverage.

Compare Level Term Life Insurance

One of the major features of degree term protection is that your premiums and your fatality benefit do not transform. You might have protection that starts with a death benefit of $10,000, which might cover a mortgage, and after that each year, the death benefit will certainly lower by a set quantity or percentage.

Due to this, it's often a much more budget friendly kind of degree term coverage., yet it might not be adequate life insurance for your requirements.

After deciding on a policy, complete the application. For the underwriting procedure, you might have to supply general personal, wellness, way of life and employment information. Your insurance firm will determine if you are insurable and the risk you might provide to them, which is mirrored in your premium costs. If you're accepted, sign the documents and pay your first costs.

You might want to upgrade your beneficiary information if you have actually had any type of considerable life changes, such as a marriage, birth or separation. Life insurance policy can sometimes really feel complex.

What are the benefits of 20-year Level Term Life Insurance?

No, level term life insurance policy does not have money value. Some life insurance policy plans have an investment attribute that enables you to build money value with time. What is level term life insurance?. A part of your premium payments is established apart and can make rate of interest over time, which grows tax-deferred throughout the life of your coverage

Nevertheless, these plans are often significantly a lot more expensive than term insurance coverage. If you get to completion of your policy and are still alive, the coverage finishes. However, you have some choices if you still desire some life insurance policy protection. You can: If you're 65 and your protection has gone out, as an example, you might desire to acquire a new 10-year level term life insurance policy plan.

What does a basic Level Term Life Insurance Policy Options plan include?

You might be able to convert your term insurance coverage right into an entire life plan that will certainly last for the remainder of your life. Numerous sorts of degree term plans are exchangeable. That indicates, at the end of your protection, you can transform some or all of your plan to whole life coverage.

Level term life insurance policy is a policy that lasts a set term normally between 10 and three decades and features a level survivor benefit and degree costs that stay the exact same for the entire time the policy is in impact. This implies you'll recognize exactly just how much your payments are and when you'll need to make them, permitting you to budget plan as necessary.

Degree term can be a great choice if you're wanting to acquire life insurance policy protection for the first time. According to LIMRA's 2023 Insurance Barometer Research Study, 30% of all grownups in the United state requirement life insurance coverage and don't have any type of plan. Level term life is predictable and cost effective, that makes it among the most prominent sorts of life insurance policy

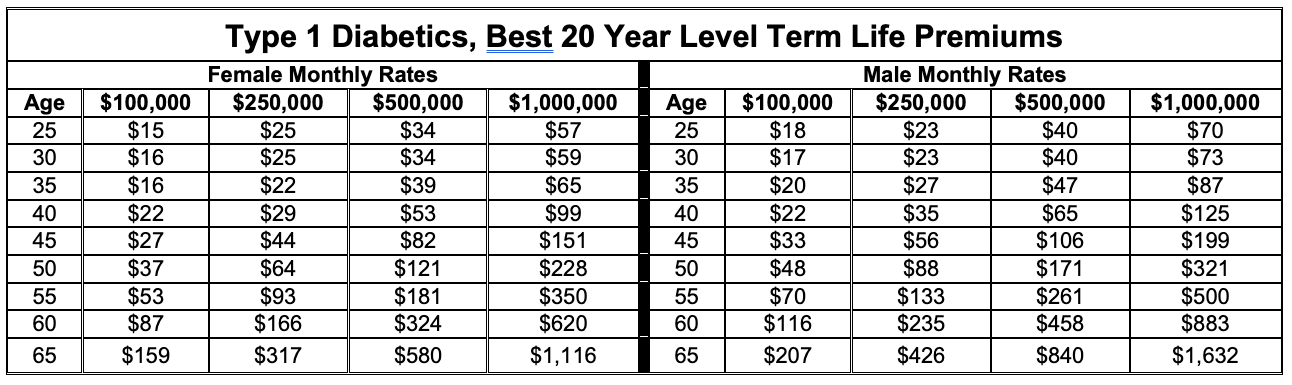

A 30-year-old man with a similar profile can expect to pay $29 per month for the exact same coverage. AgeGender$250,000 protection quantity$500,000 coverage quantity$1 million insurance coverage amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Methodology: Average monthly rates are computed for male and female non-smokers in a Preferred health category acquiring a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy policy.

Who provides the best Level Term Life Insurance Vs Whole Life?

Prices may vary by insurance firm, term, coverage quantity, wellness class, and state. Not all policies are readily available in all states. Price image legitimate since 09/01/2024. It's the most inexpensive form of life insurance coverage for most individuals. Level term life is far more affordable than a comparable entire life insurance coverage plan. It's simple to handle.

It permits you to spending plan and plan for the future. You can easily factor your life insurance coverage right into your budget plan since the premiums never change. You can prepare for the future simply as conveniently since you understand exactly how much cash your loved ones will certainly receive in case of your absence.

What is the difference between Level Term Life Insurance Calculator and other options?

This holds true for individuals that quit cigarette smoking or that have a health and wellness condition that solves. In these instances, you'll usually have to go via a new application procedure to get a much better price. If you still require protection by the time your level term life policy nears the expiration date, you have a few alternatives.

Table of Contents

Latest Posts

20-year Level Term Life Insurance

What is Term Life Insurance With Accelerated Death Benefit? How It Works and Why It Matters?

How long does Flexible Premiums coverage last?

More

Latest Posts

20-year Level Term Life Insurance

What is Term Life Insurance With Accelerated Death Benefit? How It Works and Why It Matters?

How long does Flexible Premiums coverage last?